Table of Contents

Tesla Stock is a powerhouse in technology, an innovator of energy, and a symbol for the electric vehicle revolution. For investors, the Tesla Stock , which is traded on the NASDAQ under the ticker TSLA, has been one the most talked about, volatile and potentially rewarding assets in the 21st Century. This article takes a look at Tesla’s stock in detail, including its history, what drives its price and its future.This blog is related to financeinfotech.com.

From Niche Automaker To Global Disruptor

Tesla was founded in 2003 by Martin Eberhard, Marc Tarpnning and their mission was to show that electric cars were faster, more efficient and fun to drive. Elon Musk led the first round of investment in 2004 and became the face for the company. He guided it from a small startup to a global powerhouse. Tesla’s initial publicly-traded offering (IPO) of June 29, 2010 was a historic moment. The company sold its shares for $17 and raised over $226 millions. Tesla continued to defy expectations in the years following, and silence skeptics. Tesla launched a number of revolutionary vehicles including the Model S sedan and Model X SUV.

Tesla’s reach has extended beyond cars to include clean energy storage and generation. The company’s goal is to create a sustainable energy ecosystem through products such as the Powerwall and Powerpack. Many investors who are convinced of the company’s vision for the future cite this diversification as a major part of their investment thesis.

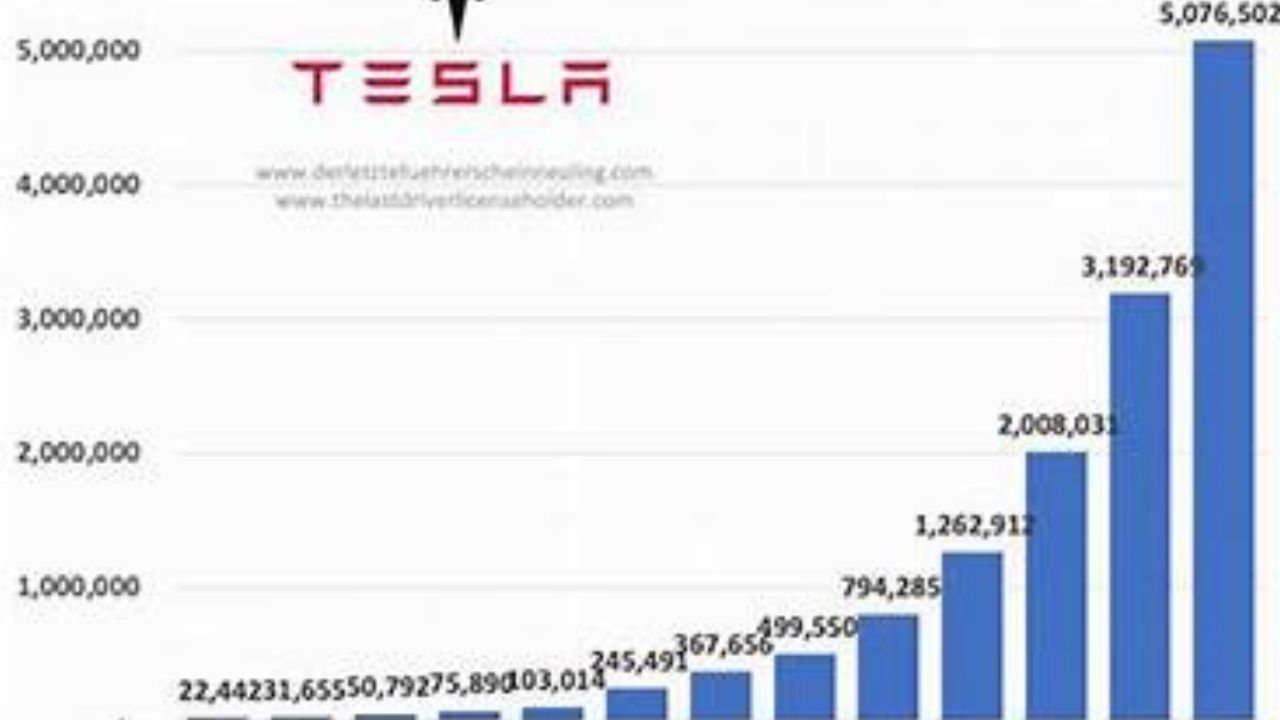

Tesla Stock Performance: A Rollercoaster ride over the years

Tesla’s journey has not been smooth. The story has been one of extreme highs followed by gut-wrenching, rapid corrections. Early investors who stayed in the market through all of the volatility saw astronomical returns. For its first few decades, the stock’s trading range was relatively modest.

Tesla split its stock to make it more accessible for retail investors. First, a split of 5:1 was implemented in August 2020. This was followed by a split of 3:1 in August 2022. A stock split does not change the company’s fundamental value, but it can lower the price per share. This can increase trading volumes and attract a wider base of investors. Investors who purchased a single stock before 2020 will have 15 shares at the end of 2022.

What Moves The Needle? Tesla Stock Price: Factors that Influence it

1. Production and delivery numbers for vehicles

Tesla’s quarterly report on production and deliveries is the best indicator of its performance. Wall Street analysts as well as investors closely monitor these numbers. Stocks often rise when they consistently meet or beat expectations. However, any signs of a slowdown can cause a steep sell-off. These figures are a direct indicator of the consumer’s demand and a company’s capacity to scale up its operations.

2. Financial Performance and Profit Margin

Tesla’s financial strength is important, even though it does not directly impact deliveries. Automotive gross margins are the key metrics. Tesla Stock has enjoyed the highest profits in the industry thanks to its manufacturing innovations, direct-to consumer model, and high-margin upgrade such as Full Self Driving. Investors worry about the possibility of a decrease in profit margins as a result of increased material costs and competition.

3. Elon Musk’s Influence

Elon Musk’s CEO role has an unique impact on his company’s stock price. Elon Musk’s announcements, interview and presentations at company events can cause wild price swings. A single tweet could make or break the stock value of Tesla in minutes. Some see his unpredictable nature and involvement in other projects, like SpaceX and X, as a potential risk.

4. Tesla dominated the EV market for many years.

The landscape is changing rapidly. Ford, General Motors, Volkswagen, and Hyundai are established automakers that have launched compelling EVs. Rivian Lucid, Chinese powerhouses BYD NIO and BYD are all battling for market share. Tesla’s mission relies on technological breakthroughs, such as cost reductions and an increase in energy density. Battery Day, which is held by the company every year, can have an impact on investor sentiment. Tesla is valued in part because of the promise of autonomous vehicles. A “Robotaxi Network” and the progress made on FSD software is a huge catalyst. New Products: The launch of new vehicles, such as Cyber trucks and the development of a cheaper next-generation vehicle will create new markets.

Recent Developments and Future Outlook

Tesla Stock continues to navigate an ever-changing and complex market. The company has recently focused on increasing the production of the Cyber truck. This vehicle has a radical design and has attracted a lot of public attention. This launch was seen as a test for Tesla’s ability in bringing unconventional products to the market.

The company has also increased its focus on artificial intelligence. The Dojo supercomputer will process massive amounts of video data collected from the company’s fleet of vehicles to accelerate training for its autonomous driving software. Tesla’s long-term goal is to have its cars operate as autonomous taxis in the future, which will generate recurring revenues for both their owners and Tesla.

The future of Tesla Stock looks like a mixture of enormous opportunities and significant challenges.

The Bull Case: Tesla supporters believe that the company is only in its early stages of growth. They claim that the company has a significant lead in AI, software and manufacturing efficiency. As the leader in electric vehicles, Tesla will continue to reap benefits. Tesla’s growth could be accelerated if it cracks the code to full autonomy, or launches an affordable electric vehicle.

Skeptics are pointing to Tesla’s high valuation as a factor that will affect its future success. They claim that increased competition will inevitably reduce Tesla’s profit margins and market share. The risks are significant if Tesla fails to deliver on promises such as the Robotaxi network and faces regulatory obstacles for autonomous driving. The reliance on one high-profile CEO also raises concerns for those concerned about key-person risks.

Frequently Asked Question

1 Is Tesla Stock a Good Investment?

There is no simple answer to this question. Your investment goals, your risk tolerance and your time horizon will determine the answer. Tesla is a great investment for long-term investors that believe in the vision of the company and are willing to accept extreme volatility. Its high valuation could mean that it experiences significant downturns in the event it does not meet its lofty expectations. It is considered to be a growth stock with high risk and high reward.

2 What are the major risks associated with investing in Tesla?

Stocks often trade at a premium to other automakers. This makes them vulnerable to price corrections.

Competition: The EV industry is getting more crowded. This could put pressure on Tesla’s profits and sales.

Execution risk: Future growth of the company depends on launching new technologies and products, such as Cyber trucks and FSDs, but this is not guaranteed.

Elon Musk, the CEO of the company, is a key person who can pose a risk. Elon Musk’s actions and focus may create volatility.

Tesla Stock could be affected by the changing regulations surrounding autonomous driving, safety standards and environmental credits.

3 What percentage of my portfolio should be allocated to Tesla Stock?

Financial advisors usually recommend that single, highly volatile stocks such as Tesla make up only a small portion of a well diversified portfolio. If a company’s performance is poor, you could be exposed to a significant amount of risk by allocating too much capital. Your personal financial situation and your risk profile will determine the right allocation.

4 IsTesla Stock pays a dividend?

Tesla does not pay dividends at this time. Tesla, like many other high-growth businesses, reinvests its profits to fund R&D, build new factories and scale operations. The company stated that it did not expect dividends to be paid in the near future.

Conclusion

Investing in Tesla shares is an investment into a vision of a future that is electric and autonomous, powered by renewable energy. The company has proven time and again its ability to disrupt industries and innovate, and it rewards its early and steadfast investors.

Leave a Reply