Table of Contents

Stimulus checks—officially known as Economic Impact Payments—have quickly become familiar in households everywhere, providing much-needed support for millions. But with these payments often come questions, especially around tax time. Will a stimulus check affect your tax return? Is it counted as taxable income? And what This blog is related to financeinfotech.com.

Figuring out how stimulus payments connect to your taxes can feel complicated, but it doesn’t have to be overwhelming. Let’s walk through everything you need to know, from how these payments work to what you should expect come tax season.

Looking Back: The Story Behind Stimulus Checks

You might think stimulus checks are a new idea, but the government has actually used similar tactics before. In tough economic times, like after the dot-com bubble in 2001 or the Great Recession in 2008, direct payments went out to Americans in hopes of jumpstarting the economy.

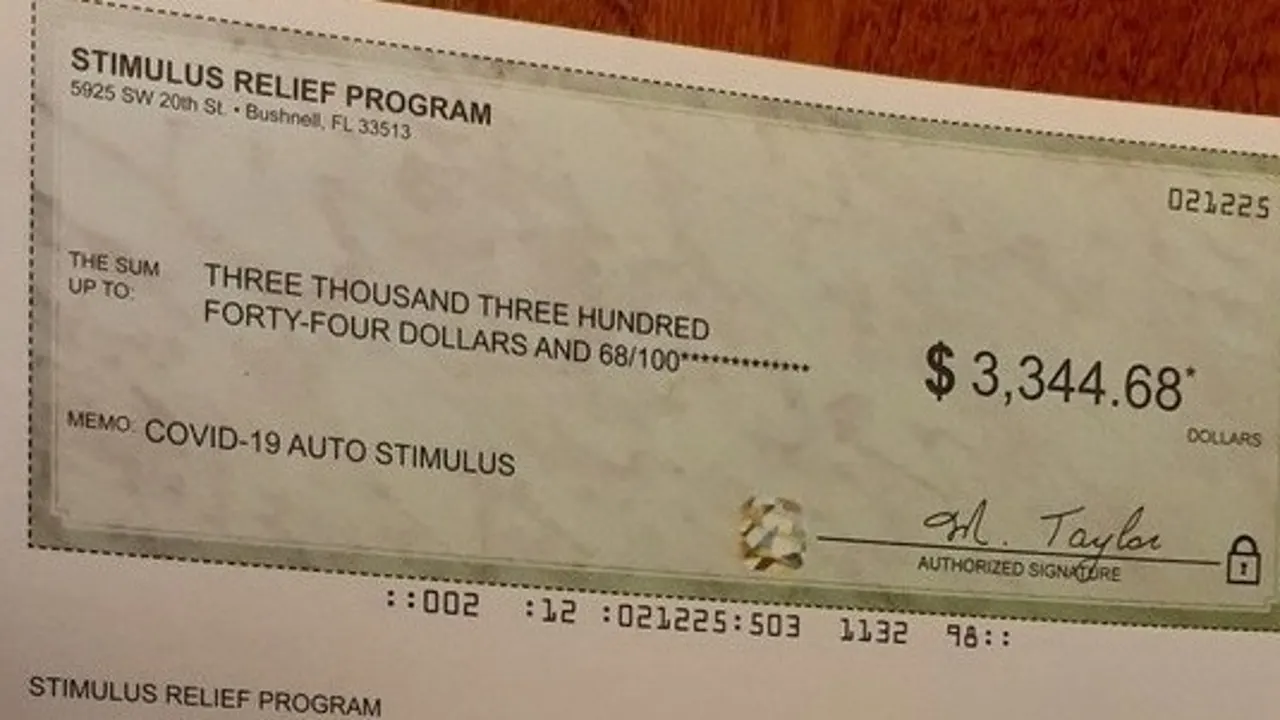

However, nothing matched the scale and speed of the checks sent out in response to COVID-19. Starting in 2020 with the CARES Act, the U.S. government approved several rounds of direct payments to help people deal with job losses, reduced hours, and all-around economic stress. The purpose? Make sure families could cover essentials—rent, groceries, utilities—while keeping the bigger economy moving. It was such a major effort that “stimulus check” became a regular term in everyday conversation.

The Big Question: Do You Owe Taxes on Stimulus Checks?

Stimulus checks aren’t counted as taxable income. This is something that confuses a lot of people, but here’s why: these payments are actually considered an advance on a refundable tax credit (called the Recovery Rebate Credit, in the 2020 and 2021 rounds).

Think of a tax credit as money that directly reduces your tax bill. A refundable credit is even better—if the credit is bigger than your total taxes owed, you get the difference as a refund. Since your stimulus check is just an early payment of this tax credit, it’s not seen as income. You won’t have to pay taxes on it, it won’t boost your tax bill, and it won’t shrink your usual tax refund. You can keep those funds, no strings attached.

How Did They Decide Who Got Stimulus Payments (and How Much)?

Eligibility for stimulus checks depended mostly on your Adjusted Gross Income (AGI)—basically, your income after certain deductions. The idea was to focus help on low- and middle-income households. To figure out how much you qualified for, the IRS looked at your most recent tax return (from the previous year, or the year before that).

Payments started at the full amount if you were under a set income threshold. For example, individuals making under $75,000 got the full payment, while the amount phased out above that limit. The exact thresholds were higher for heads of household and married couples filing jointly. Dependents often meant more money, too. In the first two rounds, this was mostly for children under 17. By the third round, adult dependents and college students could count as well.

Stimulus Checks and Economic Recovery: Why Send Them?

On a bigger scale, stimulus checks do more than just help individuals—they’re designed to help the entire economy bounce back. The thinking here is pretty straightforward: when people have extra cash, they tend to spend it. That creates more demand for products and services, letting businesses keep their doors open and workers employed.

This sort of “demand-side” boost is about preventing a downward spiral—if everyone stops spending because they’re worried about money, businesses struggle and start letting employees go, which only makes things worse. By getting money directly into people’s hands, the government hopes to short-circuit that cycle. Recent checks seemed to work as intended. Many households used the funds immediately for things like food and rent, helping them avoid really tough choices. Others paid off debt, strengthening their long-term finances. Some set the money aside for emergencies or invested it. All these actions kept spending—and economic confidence—from bottoming out during some pretty uncertain times.

Clearing Up Common Myths

There’s a lot of misinformation out there, so let’s set the record straight on a few common misunderstandings:

- My stimulus check will lower my tax refund.Not true! Since the payment is an advance on a refundable credit, it doesn’t reduce your tax refund. Your refund is based on your income, withholdings, deductions, and other credits.

- If I owe back taxes, the government will take my stimulus check.In most cases, this didn’t happen. The checks were protected from most federal and state debt collections, including overdue taxes. However, overdue child support could be an exception.

- If my income was higher in 2019 but dropped in 2020, I missed out. Not always! This is where the Recovery Rebate Credit comes in. If you didn’t get all (or any) of your payment because your most recent tax return showed higher income, but your income later qualified, you could claim any missing amount on your tax return.

Your Tax Filing To-Do List

1. Reporting Your Stimulus Payment

While the money isn’t taxable, you may need to tell the IRS how much you got. After each payment, the IRS sent out a notice (like Notice 1444, 1444-B, or 1444-C) telling you your payment amount. When you go to file, your tax software or preparer will likely ask for these numbers. It’s not to charge you tax, but to ensure you got the full amount you’re entitled to.

2. What to Do If You Missed a Payment

If you were eligible for a check, but it never showed up—or if you should’ve gotten more (maybe you had a baby or a new dependent since the last tax return the IRS reviewed)—you can still get that money. The solution is the Recovery Rebate Credit. When filing your federal taxes for the relevant year, there will be a place to claim this. Most tax software will guide you step by step, checking your income, filing status, and dependents, then figuring out if the IRS still owes you anything. If so, that amount gets added to your refund or helps pay off any tax you owe.

What’s Next for Stimulus Payments?

The last few years proved just how powerful and effective direct payments can be in a national emergency. Economists see them as a fast, effective way to help people and keep the economy afloat. Going forward, it’s likely these kinds of payments will remain part of the toolkit for responding to big economic shocks.

The big questions still being debated: How big should future payments be? Who should get them? How frequently should checks go out? Some experts even suggest building “automatic stabilizers” into policy—that is, sending payments automatically when key economic indicators (like unemployment rates) hit certain levels, so it’s not just a one-off decision every time. Bottom line: While stimulus checks are emergency relief, their connection to your taxes is at the heart of how they work. Remember that they’re not taxable income—they’re non-taxable advances on tax credits meant to support you. If you keep your notices and pay attention when filing, you should get every dollar you’re owed

FAQ

Are stimulus checks taxable?

No, the IRS does not count stimulus checks (Economic Impact Payments) as taxable income. They are just advance payments of a tax credit known as the Recovery Rebate Credit. You won’t owe extra taxes, and they won’t drop your refund.

How do I get a missing stimulus check?

If you were eligible but missed out—either you got nothing or less than you should’ve—file for the Recovery Rebate Credit on your tax return for the year the payment was supposed to arrive (e.g., 2020 returns for the first two checks, 2021 for the third).

Will getting a stimulus check change my tax refund?

Not at all. Stimulus payments are entirely separate from your standard refund calculation. In fact, if you’re owed more, claiming the Recovery Rebate Credit will increase your refund or lower the taxes you owe.

What if I didn’t file taxes—can I still get a stimulus check?

Yes. You don’t need to owe taxes to qualify. Many people who usually don’t file (such as some folks on Social Security or veterans’ benefits) were still eligible. The IRS pulled info from other agencies or provided a simple online way for “non-filers” to sign up. If you missed that, you can still file a return for the relevant year and claim the credit.

What if I got a letter from the IRS about my payment?

Hang on to it! Any notice from the IRS, like Notice 1444, confirms how much you got (or should have gotten). Store it with your tax docs—you might need it when you file, especially if there’s any confusion about what you received and what you’re owed.

Conclusion

As we look to the future, stimulus payments may continue to play a key role in economic policy, offering a safety net for individuals and families when they need it most. By staying informed and proactive, you can navigate tax season with confidence and make the most of these financial lifelines.

Leave a Reply