Table of Contents

To understand the value a dollar we must first understand what actually is. Money is fundamentally a medium for exchange a unit to account and a storage of value. Money allows us to exchange goods and services, without the need for bartering. This blog is related to financeinfotech.com.

What is money, really?

Like most modern currencies this is also known as Fiat Money. It’s not backed up by physical commodities like gold or sterling silver. It’s instead backed by the “full trust and credit” of U.S. Government. Simply put, people believe it’s worth something because others do.

The Gold Standard: Back when the Dollar had a physical backbone

Throughout most of its history, the U.S. It has been backed with gold. In the Gold Standard every dollar could be exchanged against a certain amount of gold. The value of money was directly linked to a tangible asset.

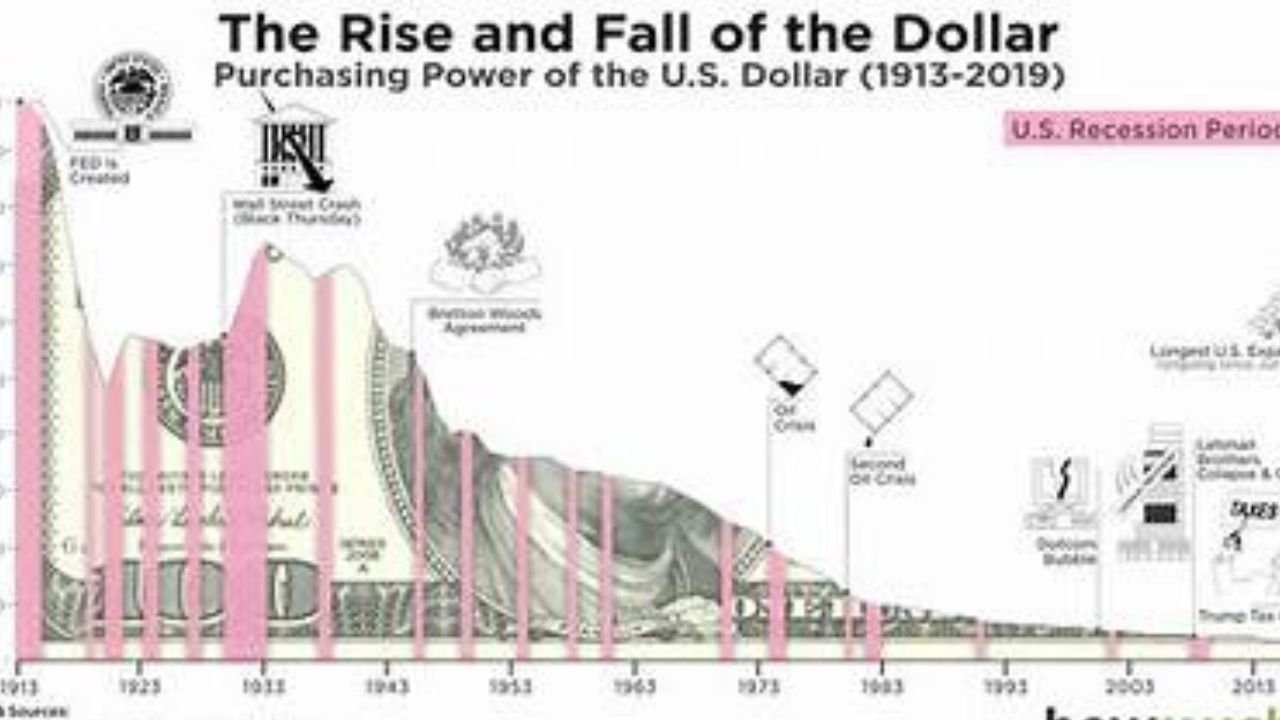

In 1971, however, President Richard Nixon ended the ability to be converted into gold. The U.S. Dollar became pure Fiat Currency after that, its value being determined by economic factors instead of a gold reserve.

Supply and demand: The invisible hand at work

The value is affected by demand and supply, just like any other commodity. If the U.S. issues more money than the economy can bear, the value can drop. Conversely, if demand for the dollar increases internationally–such as through foreign investment or oil trades (most of which are done in USD)–its value goes up.

Inflation is the silent erosion of value of dollar.

Inflation is one of the ways that we can feel the changing value. Inflation occurs when the prices of goods and services increase over time. This means that each dollar you spend will buy less.

In the 1950s a loaf of white bread could have cost as little as 10 cents. It could cost as much as $3 today. It’s not that the bread is more valuable, but rather that it is worth less compared to other goods. The Federal Reserve aims to keep inflation at around 2% per annum to encourage economic development without eroding buying power too quickly.

The Federal Reserve and Interest Rates

The Federal Reserve Bank (the Fed), the U.S. central bank, plays an important role in determining value through rate policy.

When the Fed increases interest rates borrowing becomes more costly, reducing money supply and strengthening dollar. It lowers interest rates. Borrowing is easier and spending increases. It could weaken. This balance act affects everything, from mortgage rates to grocery prices and even international investments.

Demand for Dollars in the Global Market

The U.S. Dollar is strong because it’s used as a currency around the world. This is held by countries to pay their international debts and trade, as well as stabilize their currencies.

USD is the currency of choice for over 80% of all international transactions. About 60% of the world’s foreign exchange reserves are in USD. The global fund increases its value.

The exchange rate factor

The exchange rate, or how much one currency is valued in relation to another, is also an important measure of value. If the U.S. strengthens against the Euro or Yen, this means that the dollar’s purchasing power has increased internationally.

It affects foreign investment, travel, and imports. A strong dollar can make imports cheaper, but it can also hurt American exporters as U.S. goods are more expensive overseas.

National Stability and Economic Indicators

Investors and traders are constantly monitoring U.S. economic data to determine the health status. GDP growth, Employment data, Manufacturing Output, Consumer Confidence, Government debt levels, Investor confidence is increased by a stable and growing U.S. Economy, which increases demand for it and boosts its value.

Trust: the Psychological Value Currency

It is worth only what people think that it’s worth. Confidence is important. In times of crisis–like war, financial collapse, or political instability–confidence in a currency can plummet, causing its value to fall sharply.

This is why hyperinflation can be so dangerous. People stop using a currency when they lose confidence in it. Its value can then spiral down to zero as in Venezuela and Zimbabwe.

Currency swap Rates :

The Abroad The foreign swap (forex) industry is where currencies are traded, and the importance is repeatedly measured against other currencies like the euro (EUR), yen (JPY), or pound (GBP) . A healthy dollar intends it can buy more of an additional currency, making imports less expensive and abroad voyage more affordable for Americans . But it can additionally damage U . S . exporters because American goods, commodity, output, mercantile, supplies, ,capital

become more costly for foreign buyers . A feeble does the opposite—it distinguishes U . S . exports less expensive and more competitive but distinguishes imports more costly

The Future of Value

The value will continue to change as the world shifts to digital payments, mobile wallets and even Central Bank Digital Currency (CBDCs).

Bitcoin and other crypto currencies are already challenging the fiat currency, posing questions about trust and centralization.

Frequently Asked Questions

1 : Why does the U.S. Dollar dominate globally?

The U.S. is a world leader in financial markets because of its size, stability, military and political power and the trust that the global community has for its financial system. The dollar is the currency of choice for most international trade, which strengthens its position.

2 – Can the dollar completely lose its value?

Theoretically, yes. This could crash if people lose confidence in the U.S. economy or government. This is unlikely, given the current global structure.

3 – What happens when the Fed prints a lot of money?

Inflation is caused by too much money being in circulation, and this reduces the buying power of the US . Hyperinflation can result if the problem is not addressed.

4 – How does inflation impact my money?

Over time, inflation means that your money will buy less. If inflation is 3% per year, for example, $100 will be worth $103 in a year.

5 – Why does the U.S. not return to the gold standard?

The gold standard may limit inflation but it can also limit economic flexibility. A gold-backed currency does not allow modern economies to easily adjust their monetary policies.

Conclusion

The importance goes far over its physical form—it’s shaped by economic brawn, regime policy, global request, and, most importantly, public believe . Though no longer backed by buttercup, it preserves its power over self-assurance in the U. S . economy and financial method . influences like inflation, interest rates, provide and request, and global trade all impact how much a it can buy at any given time . In a globe that’s swiftly changing position toward digital currencies and cashless systems, its worth helps us make smarter financial decisions and thank the complicated forces behind something we make use of on daily basis .

Leave a Reply